Overview of Amazon Workflow with Webgility Desktop

Overview of Amazon Workflow with Webgility Desktop

Launching an Amazon business is exciting. There are a lot of opportunities and a low entry hurdle. However, 80% of Amazon sellers say that bookkeeping and accounting are their biggest challenges.

Amazon has always been challenging to reconcile with all the expenses and fees on the Amazon settlement reports. The expenses and fees provided by Amazon are more complex compared with other marketplaces and shopping carts.

How Webgility can help in streamlining the reconciliation process?

Webgility integrates with these Amazon FBA & FBM marketplaces:

To keep track of Amazon order transactions, expenses, fees, and refunds Webgility has created an innovative way to help a seller reconcile their Amazon order data.

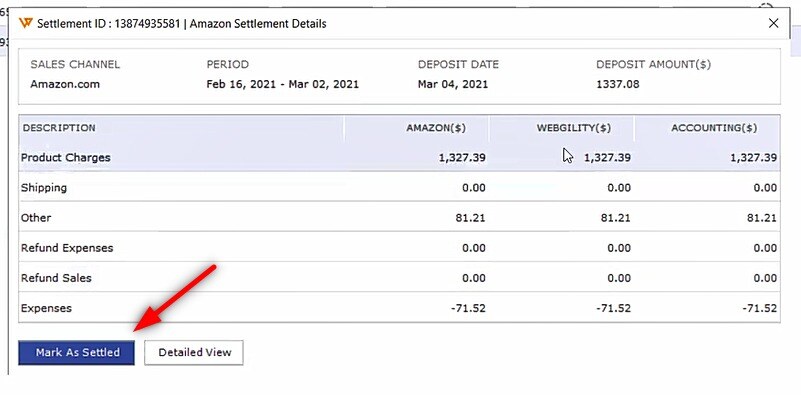

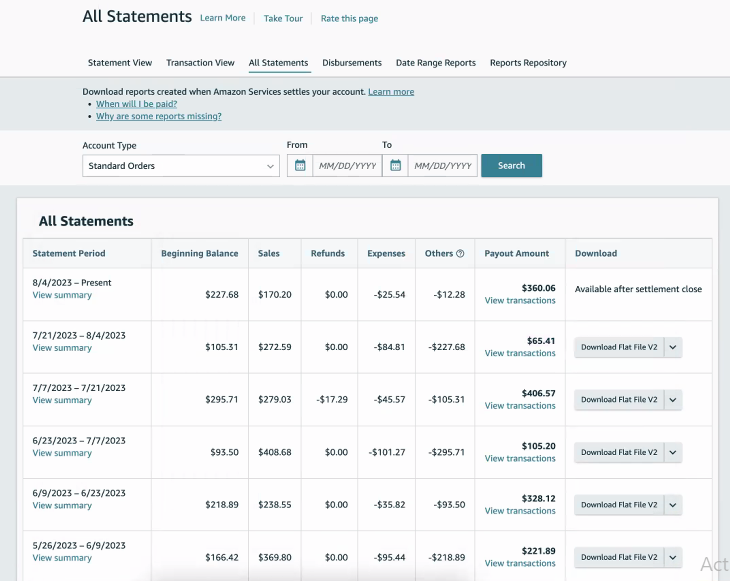

Amazon provides settlement reports every 2 weeks. The settlement reports consist of the total number of sales transactions, Expenses & Fees (Commission, Advertising, FBA-related fees, Shipping Costs, etc.), and refunds recorded by Amazon during the settlement period.

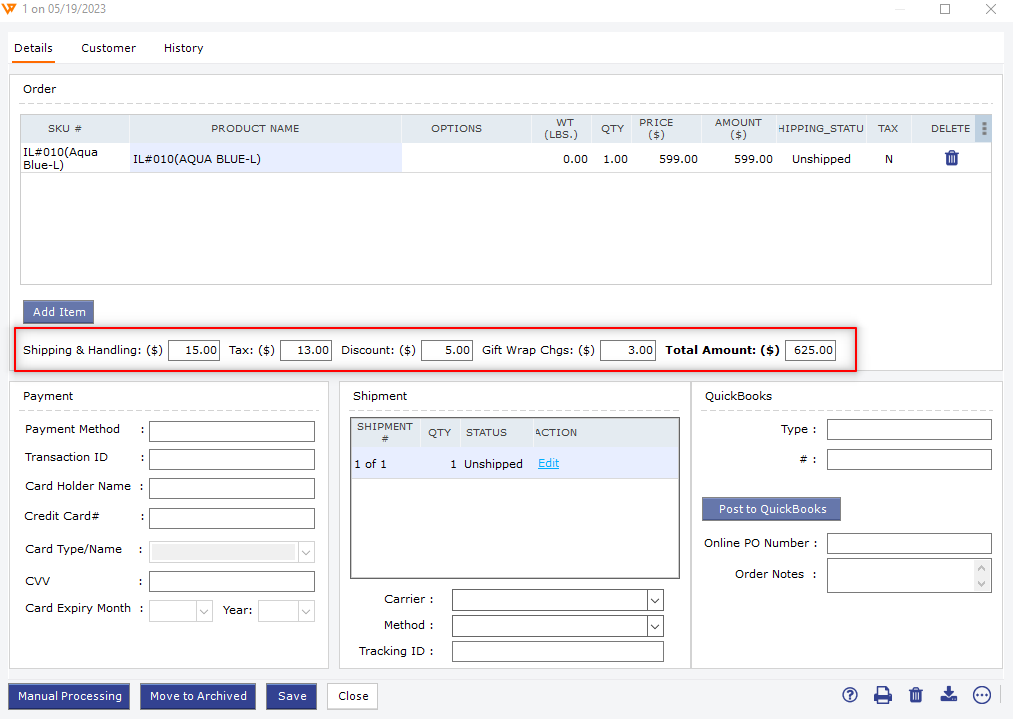

Webgility receives Amazon orders on a daily basis and posts them to accounting. The order includes item information, for example, qty, price, and order total.

The expenses, fees, shipping fees, refunds, and other charges are not available when orders are downloaded. Once the settlement reports are available on Seller Central, Webgility downloads and posts the settlement reports with final order transaction amounts along with all the expenses, fees, shipping, and refunds.

Example:

A settlement period for Amazon is 2 weeks, not necessarily falling at the end of each month. An overview of the example details are as follows:

Sale: $10000

Expenses & Fees: $3500

Deposit: $5500

Current Reserve or Holding Balance: $1000

With Amazon, identifying the expenses and commissions charged based on individual orders is difficult. Many expenses and fees are not directly tied to a particular order. Webgility plays an essential role in recording all the transactions, expenses, fees, shipping, and refunds to QuickBooks.

Webgility’s process to help with reconciliation:

-

We suggest our customers create a separate clearing or holding account as Type “Bank” in QuickBooks to record all Amazon transactions.

Webgility downloads and posts orders on a daily basis to the clearing account using invoices. The invoice will be set as paid when the settlement report is downloaded and posted. Following the example the balance of the clearing account would be $10000. -

When Webgility downloads and posts the settlement report, the orders will be marked as paid and the expenses, fees, shipping, and refunds will be posted to QuickBooks to the same clearing account as a check and check/deposit. This will reduce the amount from the total in the clearing account. Following the example $10000 - $3500 = $6500

-

To complete the reconciliation you will transfer the amount of the Amazon deposit for the settlement period from the clearing account to the checking or other account. Following the example $6500 - $5500 - $1000 = $0

-

Now, the Current Reserve Balance of $1000 will become the Previous Reserve balance in the next settlement report that will carry forward, and this balance Amazon adjusts and deposits in the next settlement.

Webgility has a recommended setup to download and post orders and settlement data automatically to QuickBooks to help with the reconciliation process.

Recommended Settings for Amazon with Webgility Desktop

After the configuration of settings follows the below-mentioned steps to post the transactions.

-

Make a transfer entry from the clearing account to the checking account.

Follow this helpful article to reconcile the data in QuickBooks.