Invoice Payment Creation Failed

This article helps Webgility Desktop users resolve the "You can't create a payment more than the amount due" error in Webgility Desktop. The error typically occurs due to tax mismatches between the sales channel and QuickBooks Desktop or unmapped payment methods. The article provides solutions for both standard order posting scenarios and payout settlement errors related to Shopify or Amazon.

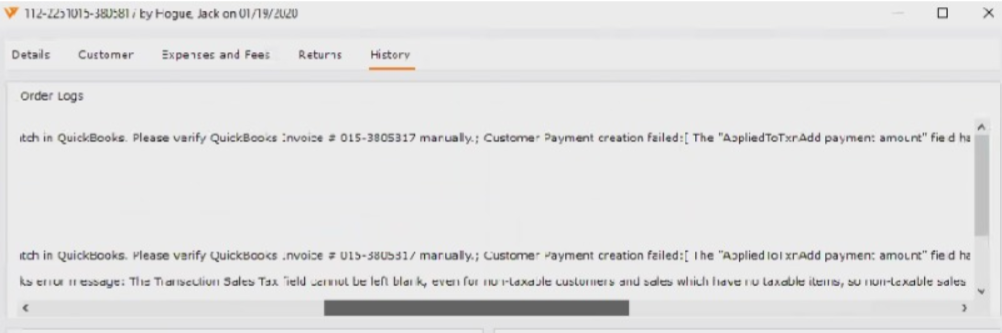

Error Message:

When posting orders as a paid invoice, the invoice gets created, but payment creation fails and shows the following error: You can't create a payment more than the amount due.

Reason:

The invoice amount is less than the payment amount when creating the payment for the invoice. This is likely due to the tax being calculated differently between the sales channel and QuickBooks Desktop. If the sales channel tax is greater than what QuickBooks Desktop calculates it as this causes a difference, and the payment cannot be applied to the invoice.

Scenario 1:

Enable Mark Invoices Paid (for a single type of transaction only)

To resolve this issue, you will need to either correct your tax calculation in your sales channel or in QuickBooks Desktop to make sure the tax calculation is the same in both. Or, you will need to select an option in Webgility Desktop called “Create payment of transaction total in QuickBooks Desktop.” This will cause Webgility Desktop to create a payment based on the invoice total rather than the order total.

If the user is posting orders based on payment method and there is a new payment method on the order, Webgility Desktop isn’t posting the payments for those orders. The user needs to map the payment method to Webgility Desktop to create payments. To map payment methods on Webgility Desktop, Follow the steps in this helpful article on: Map Payment Method with QuickBooks Desktop

Follow the steps in this helpful article on: How to Post Transactions Based on Payment Methods in Webgility Desktop

Scenario 2:

Payment creation failed when posting the Payouts/Settlement report.

If a user is posting the Shopify payout or the Amazon Settlement report, then the user needs to enable the payment settings “create payment when posting payouts/settlement with payment date as payout/settlement date” to record the payment in QuickBooks Desktop.

Navigate to Connections> Accounting POS/ERP> Sync Settings> Orders to enable “create payment when posting payouts/settlement with payment date as payout/settlement date.”

After saving the create payment settings, post the payouts/settlement reports to QuickBooks Desktop, and the payments will be successfully created.