Expenses Post to QuickBooks Failed Due to There was an Error when Saving a Check. QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor.

This article guides Webgility Desktop users who encounter errors while posting Amazon Settlement Reports to QuickBooks Desktop. Such errors may arise from using an outdated report posting flow or from misconfigured expense accounts in QuickBooks Desktop. The guide provides steps to verify the Webgility flow version, adjust expense account settings, and confirm proper configuration to ensure successful report posting and maintain accurate financial records.

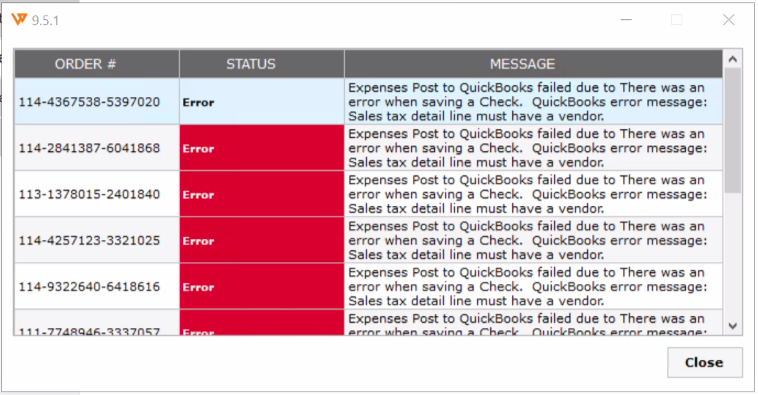

Error Message:

Expenses Post to QuickBooks Failed Due to There was an Error when Saving a Check. QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor.

Troubleshooting:

-

In Webgility navigate to Connections> Accounting/POS/ERP > Sync Setting > Expenses and Fees to verify the expense account that is configured for Check setup under the expenses and fees settings.

-

Then navigate to your QuickBooks company file and try to create a “Check” manually with the same account. If it gives you any error then setup a new expense account, and download the latest accounting data in Webgility Software by going to Connections > Get latest data and settings > Download QuickBooks Data and settings > Download Data.

-

Once done, navigate to Connections > Accounting/POS/ERP > Sync Settings > Expenses and Fees> and reconfigure the new expense account under all the configurations which are for “Check” setup.

-

Once done try to post the Amazon report again.