Receipt is not balanced

This article helps Webgility Desktop users resolve the “Receipt is not balanced” error that occurs when the order total does not match the sum of its items and payments during posting to QuickBooks POS. It outlines common causes such as data entry errors, incorrect tax or payment details, and mapping issues, and provides step-by-step troubleshooting to correct these discrepancies.

Warning Message:

Cause:

The error "Receipt is not balanced" typically occurs when there is a discrepancy between the total amount of the order and the sum of the individual items or payments associated with the order. This error can occur while posting an order from Webgility Desktop to QuickBooks POS.

Here are some of the possible reasons why this error may occur:

1). Incorrect data entry: If there is an error in entering the order data, such as a typo or missing information, it can cause the receipt to become unbalanced.

2). Taxes and discounts: If there are taxes or discounts associated with the order, they may not have been entered correctly or may be applied incorrectly, causing the receipt to be unbalanced.

3). Payment discrepancies: If the payment for the order is not properly recorded or there are discrepancies in the payment amount, it can cause the receipt to be unbalanced.

4). Currency exchange rate: If the order is in a foreign currency and the exchange rate is not accurately reflected in QuickBooks POS, it can cause the receipt to be unbalanced.

To resolve this error, you should check for any data entry errors and ensure that all taxes, discounts, and payments are entered correctly. You may also need to verify the currency exchange rate if the order is in a foreign currency. Once you have identified and corrected the issue, you can try posting the order again.

Troubleshooting

Here are the steps to resolve the issue

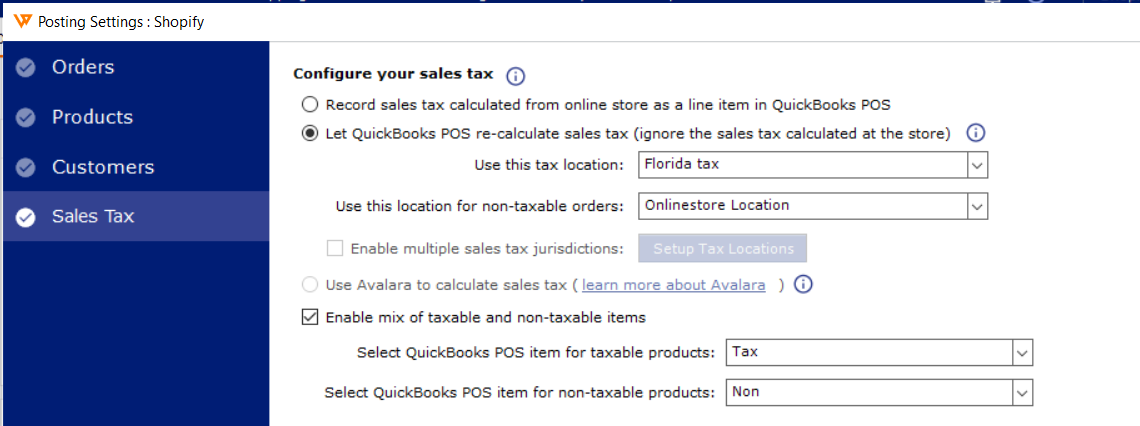

1). Check the tax settings in Webgility Desktop. Please go to Connections > Accounting/POS/ERP > Sync Settings > Sales Tax.

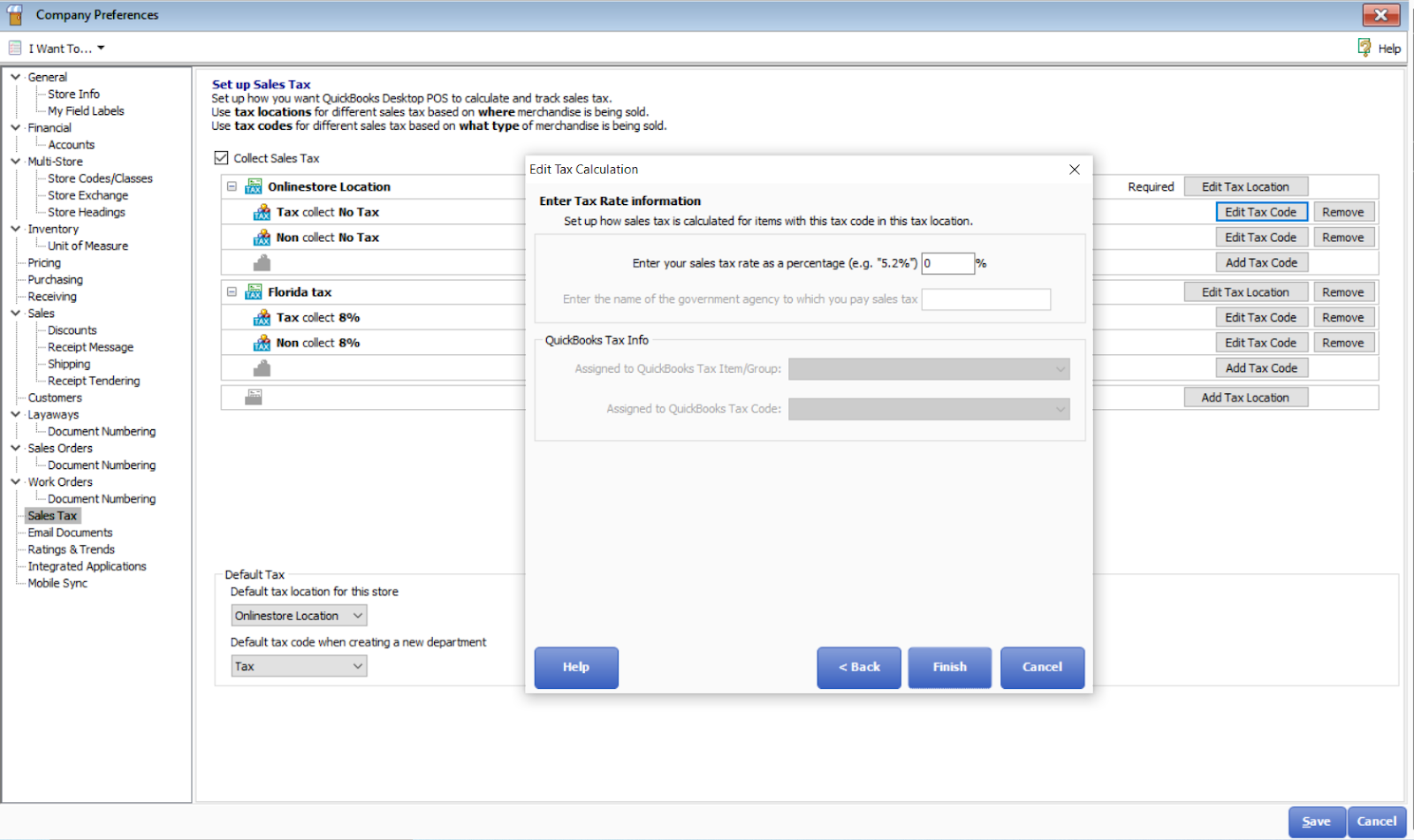

2). Ensure that the tax location selected in Webgility Desktop has a 0% tax rate defined in POS.

3). Verify that the tax item selected in QuickBooks POS is a non-inventory item.

4). Save the settings in QuickBooks POS and re-download the data in Webgility Desktop by going to Connections > Get Latest Data & Settings

5). Double-check that the item mapping is correct. If any of the inventory items are mapped with a discount item, it may result in negative pricing and cause a mismatch in the order total. Please ensure that the item mapping is accurate and that no inventory items are mapped with discount items.

6). If the item in the order is a group item, please check the option Sync price of group items before posting, under Connections > Accounting/POS/ERP > Sync Settings > Orders > Transaction settings, and click Save & Continue

7) If the setting "Get discounted item price" is checked under Connections > Sales channels > Settings, uncheck that option. Now click on save & continue.

8) Redownload the order and try to post again.