Selling and Redeeming Gift Cards

This article helps Webgility Desktop users manage the process of selling and redeeming gift cards in Webgility Desktop and QuickBooks Desktop. It explains how to configure gift card payments to download as line items, properly set up gift cards as non-inventory items in QuickBooks Desktop, and track liability accounts for accurate accounting. The guide covers both full and partial gift card redemptions, ensuring that liability balances are updated correctly and reconciled with sales activity. By following these steps, users can seamlessly handle gift card transactions within their sales channel and accounting workflow.

Selling and Redeeming Gift Cards

Do you sell and redeem gift cards? Here's how to handle them in Webgility and your accounting solution.

Most online shopping carts provide the option to purchase gift cards.

1. To download the gift card amount as a line item, in Webgility Desktop navigate to Connections> Sales channel> Settings.

2. Once you reach the Store settings window, under the Download Settings tab check the box for Gift card payment as a line item and then click Save & Continue.

3. When new orders download in Webgility Desktop, they will show the Gift Card amount as a line item in that order.

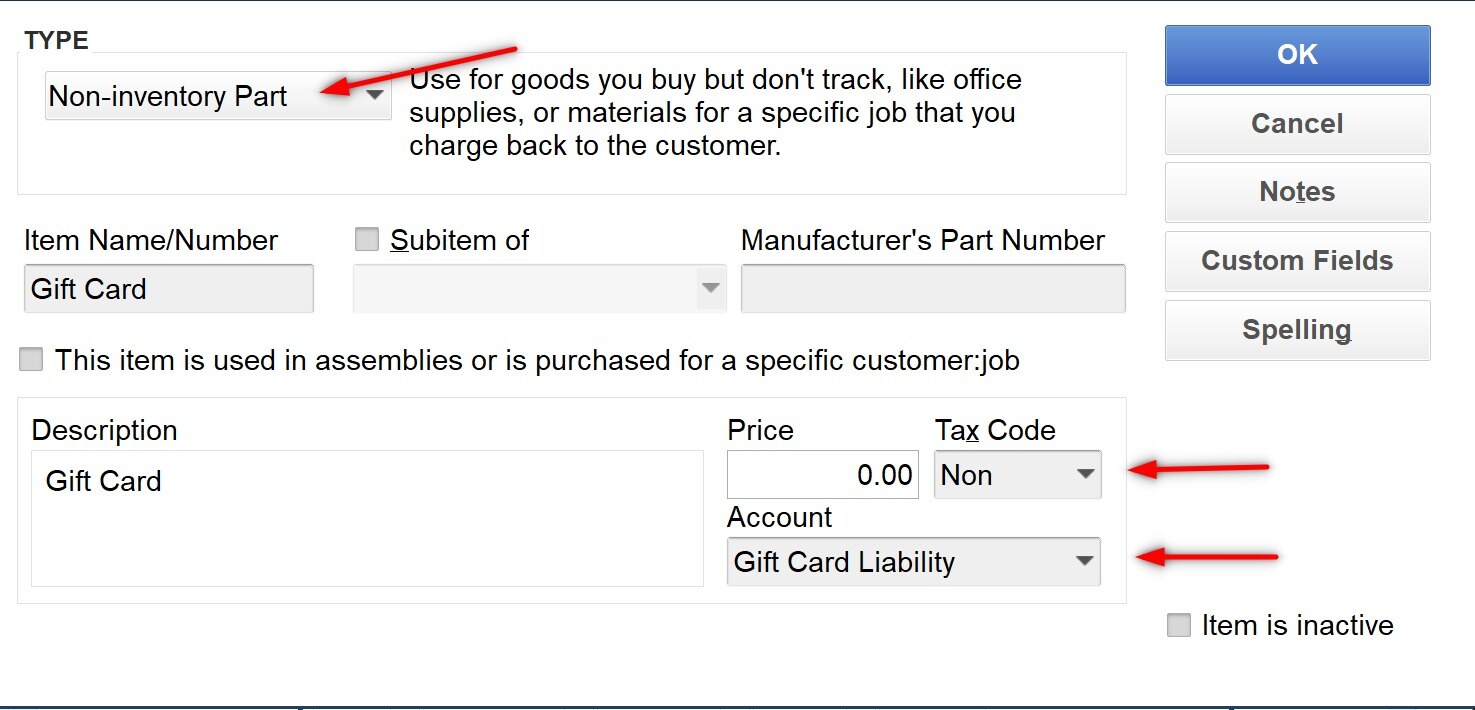

4. When selling a gift card, you must have a gift card set up as a Non-Inventory Part setup in QuickBooks Desktop. The recommended income account for this must be a gift card liability account and the item should be set to non-taxable.

As more gift cards are purchased, the liability goes up. As they are redeemed, the amount of outstanding liability goes down.

Redeeming Gift Cards

When a gift card is redeemed, it is either used as full or partial payment for an order.

Full Payment

When a gift card covers the cost of the purchase, it shows as the payment method in the order. In order for the payment to relieve some of the gift card liability, you must have the income from these payments go to a gift card holding account.

In Webgility, you can define orders with a gift card payment type to post to this account instead of your other income accounts.

When you are ready to reconcile the account with the gift card liability, zero out the holding account and offset the gift card liability by the same amount.

Partial Payment

When a gift card comes in as a payment for a portion of an order but doesn't cover the entire purchase, the process is different. In this instance it will show as a line item in the order.

This makes it a little easier to offset the gift card liability because the gift card line item can be used the same as one when it is purchased. The item will post with a negative value and deduct from the already linked gift card liability account.