Optimal Tax Set Up for Webgility Desktop and QuickBooks POS When Linked to QuickBooks Financials

This article helps Webgility Desktop users understand how to create and manage tax holding accounts in QuickBooks Financials and integrate them with QuickBooks Point of Sale. It guides users on configuring sales tax as a line item in Webgility Desktop, mapping sales tax correctly, sending orders to QuickBooks Financials, and adjusting online sales tax for filing purposes. Following these steps ensures accurate tax tracking and reporting across sales channels and accounting systems.

Create Tax Holding Accounts in QuickBooks Financials

In QuickBooks Financials, go to your chart of accounts by navigating to Lists > Chart of Accounts.

-2.jpg)

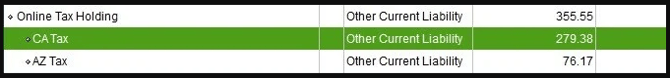

2. Create a new Other Current Liability account called Online Tax Holding. If you collect tax in multiple states, you will want to set up subaccounts for each.

3. Sync your QuickBooks Point of Sale with your QuickBooks Financials so your newly created accounts can be linked.

Create Sale Tax Items in QuickBooks Point of Sale

4. For each state, you will need to create a separate sales tax item in QuickBooks Point of Sale. Learn how here.

-Dec-06-2024-07-10-00-7576-PM.jpg)

5. Edit the QuickBooks Options on the items so the income account is the appropriate holding account for each sales tax item. Then save the changes to the item.

-3.jpg)

Configure Sales Tax as a Line Item in Webgility Desktop

6. In Webgility Desktop, you will need to enable tax to appear as a line item on the order. This step will have to be repeated for each connected sales channel.

Go to Connections > Sales channels > Settings.

7. Under Download Settings, select the box next to Get sales tax as a line item. Then click Save & Continue.

-Dec-06-2024-07-10-15-3541-PM.jpg)

8. After making this change, the sales tax in future orders will show up in the body of the transaction on the order detail in Webgility Desktop.

-Dec-06-2024-07-10-20-4173-PM.jpg)

Sales Tax Mapping Workflow

9. The first time you post an order with a new sales tax item on it, you will receive a pop up to map the mismatched item.

-Dec-06-2024-07-10-25-4604-PM.jpg)

10. When you do the SKU of the item, it should come in as the sales tax item used from your online store.

This will need to be mapped, usually by the QuickBooks Point of Sale item number.

-3.jpg)

11. Map this item to the appropriate sales tax item then post the order as normal. This only has to be done once for each sales tax jurisdiction as Webgility will remember for all future orders.

-3.jpg)

-3.jpg)

-3.jpg)

-3.jpg)

12. After you have mapped the item, attempt to post the order to QuickBooks Point of Sale once again.

-1.jpg)

-3.jpg)

Sending the orders to QuickBooks Financials

13. When you are ready to send all transactions, both online and brick and mortar sales, to QuickBooks Financials, navigate in QuickBooks Point of Sale to Financial > Update Quickbooks Desktop.

-1.jpg)

14. Clicking this will run the QuickBooks Point of Sale Financial Exchange. This may take a few minutes to complete, depending on how many sales are being sent across the systems.

-1.jpg)

15. Once the financial exchange has been completed, go to the Chart of Accounts in QuickBooks Financials. You will notice that the Online Tax Holding account(s) are starting to show the amount of tax collected.

Adjusting Online Sales Tax in QuickBooks Financials

16. Because you cannot directly transfer the amount in your tax holding accounts to your sales tax liability, you will need to complete two steps to make an adjustment to the sales tax owed when you get ready to file.

17. First, run a report on the sales tax holding account for the date range you are filing, and note the amount due. Then go to Vendors > Sales Tax > Adjust Sales Tax.

-Dec-06-2024-07-11-21-2406-PM.jpg)

18. In the Sales Tax Adjustment Pop up complete the following:

-

Select the sales tax vendor for which you are recording the adjustment

-

Choose the Sales Tax Payable account you need to adjust

-

Enter in the amount noted from above

-

Enter a memo to define what the adjustment is for

-

Click OK

+-Dec-06-2024-07-11-26-3295-PM.jpg)