How to Insure Your Shipments

This article explains Webgility Desktop users about how to set up and use Webgility Insurance for protecting e-commerce shipments. It explains the benefits of using Webgility Insurance, provides step-by-step instructions for configuration, and answers common questions about coverage, claims, and billing. The goal is to guide users through a simple process to ensure their shipments are protected and to provide clarity on when and how to file claims if issues occur.

Use Webgility Insurance to insure your e-commerce shipments

Webgility Insurance is the easiest and most affordable way to insure your e-commerce shipments. Why?

Very Low Rates

Webgility Insurance offers significant savings over carrier rates and other third-party insurance. Rates are per $100 of shipment value and are as follows:

-

USPS: $0.75

-

UPS & FedEx: $0.80*

*UPS & FedEx cover the first $100. Webgility Insurance for these carriers applies in excess of $100.

No Set-Up

Webgility Insurance is already included in Webgility, with no setup process or forms to fill out.

Easy to Use

Simply select the Webgility Insurance option when processing a shipment with Webgility.

Faster Claims Processing

Webgility Insurance is powered by InsureShip, a trusted leader in shipping insurance.

Configure Webgility Insurance

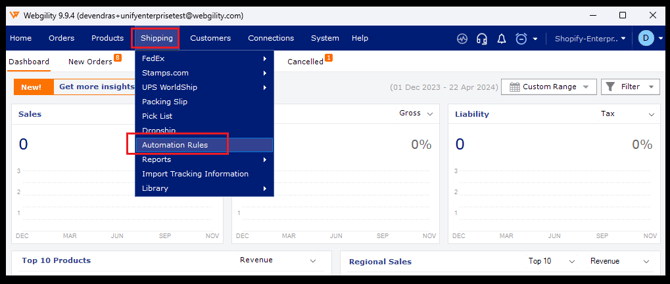

1. To configure Webgility Insurance, in Webgility Desktop navigate go to Shipping > Automation Rules.

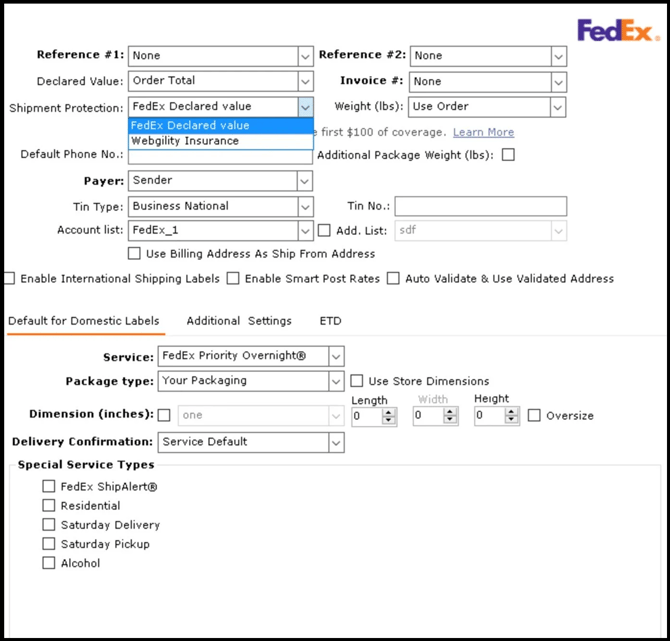

2. Select Configure.

3. In the Shipment Protection dropdown, select Webgility Insurance and enter your information.

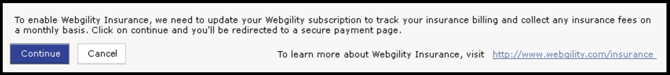

4. Click Continue. You will then be asked to restart Webgility Desktop in order for the changes to take place.

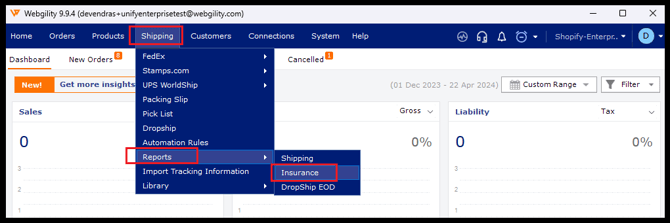

5. To run a report once you start using Webgility Insurance, go to Shipping > Reports > Insurance.

Webgility Insurance FAQs

-

How do I set up Webgility Insurance?

Insurance is already included in Webgility (starting with v.3.9.4) and set up for you! There are no forms or applications to fill out. Just select Webgility Insurance for any shipment that you want to insure. -

What is covered?

Webgility Insurance covers your packages against loss or damage during shipment. Webgility Insurance can cover packages valued up to $5,000. -

Do I have to use Webgility Insurance for every shipment?

You can choose no insurance, insurance through the carrier, or Webgility Insurance for each shipment. -

How much do I save over other insurance rates?

Webgility Insurance will save you 50-70% off of carrier insurance rates. Our rates are also far below other third-party carriers. Webgility Insurance doesn’t require any upfront deposits or other hidden fees. -

How do I get billed?

Webgility will bill you monthly for your insured shipments. We take care of everything except claims processing. -

How do I file a claim?

Webgility Insurance is powered by InsureShip, who processes all claims.Click here to file a claim online, or call InsureShip at (866) 701-3654. You can find your policy ID and your account in your Webgility Insurance Report in the Shipping menu.

If a customer’s package is lost, InsureShip must give carriers time to deliver the shipment. This is 30 days for domestic and 45 days for international.

After the time periods have been met, a customer may file for non-delivery claims. If damaged, the insured may file a notice of damage with InsureShip immediately. All claims must be filed within 90 days of the shipment date to be honored.

Once InsureShip has received a properly-executed claim, the claim will be paid within 7-10 business days.

-

Do I also need to file a claim with the shipping carrier?

For USPS shipments you file directly with InsureShip. For UPS and FedEx, if you did not elect to use Webgility Insurance to cover the first $100 of the shipment, you must first file a claim with your carrier before filing with InsureShip. -

Can I use Webgility Insurance with my Webgility trial account?

You need a paid Webgility subscription to use Webgility Insurance.

- Do I also need to file a claim with the shipping carrier?

For USPS shipments you file directly with InsureShip. For UPS and FedEx, if you did not elect to use Webgility Insurance to cover the first $100 of the shipment, you must first file a claim with your carrier before filing with InsureShip. - Can I use Webgility Insurance with my Webgility trial account?

You need a paid Webgility subscription to use Webgility Insurance.

Terms & Conditions

Policy Administered by:

Online Shipping Insurance Services, Inc. (InsureShip)

2049 Lincoln Ave Burbank, Ca. 91504

License #0G55434

Underwriters: The Navigators Insurance Group.

Carrier(s): All carriers worldwide.

Parcel Deductible: No Deductible when penny one coverage elected. All carrier deductible is otherwise applicable.

The coverage insures the parcel and its contents against damage or loss from any external cause while in transit to, or from the premises utilized by the insured and in care, custody, or control of carriers. Underwriters shall be liable for the invoice value of the property lost, destroyed, or damaged.

Policy Exclusions

Flowers, plants, fine art, cotton, fresh foods, live animals, precious stones and metals, cash in transit, cigarettes, eggs, species, securities and other negotiable papers, bulk products, laptop computers, computer chips and similar memory devices, televisions, tablets, and mobile phones - unless endorsed in writing. Merchandise shipped in consignment, memorandum, or approval unless shipped in fulfillment of an order or request.

Excluded countries: Afghanistan, Angola, Bolivia, Iran, Iraq, Nigeria, Paraguay and any other Country that is or may become Embargoed by the United States or United Nations as sanctioned by the Office of Foreign Asset Control (OFAC).

Loss, damage, or non-arrival of any parcel or the contents of said parcel which (a) is addressed, wrapped or packed insufficiently, incorrectly or contrary to the packaging requirements of the carrier being used by the insured or (b) bears a descriptive label or packaging describing the nature of the parcel’s contents. Any parcel containing personal goods to accommodate an employer or employee.

Losses (Claims) being caused by infidelity, dishonesty, or any overt act on the part of the insured, associate in interest, and/or any of the insured’s employees, whether occurring during hours of employment or otherwise, or on the part of custodians (common carriers excepted), or the property insured, unless specifically endorsed herein in writing. Resulting from inherent vice, decay, clean up costs, loss of market, loss of use, latent defect, delay, changes in temperature or humidity, or other deterioration, any remote or consequential loss, whether or not arising out of a peril insured against. Arising out of loss from delivering the product to someone who obtains it by trick, false pretense, or other fraudulent schemes.

Against loss or damage caused by or arising out of; a) hostile or warlike action in times of both peace and war, including action hindering, combating, or defending against an actual impending or expected attack; b) any weapon of combat employing atomic fission/fusion or any other radioactive force in times of both war and peace; c) insurrection, rebellion, revolution, civil war, usurped power, or action taken by government authority in hindering, combating or defending against such an occurrence, seizure or destruction under quarantine or customs regulations, confiscation by order of any government or public authority or risks of contraband or illegal transportation of trade. Nuclear Exclusion. Notwithstanding anything herein to the contrary, it is hereby understood and agreed that this policy shall not apply to any loss, damage, or expense due to or resulting from, whether directly or indirectly, nuclear reaction, radiation, or radioactive contamination, no matter what its cause.

It is warranted by the insured that all parcels under this coverage will be shipped in accordance with all regulations of the carrier and amendments thereof.

The deductible, if any, shall be deducted from the amount of the claim or liability limit, whichever is less, on a “per parcel” basis and borne by the insured. The insured is responsible for (and entitled to) collecting any amount for which the carrier may be liable.

The insured must wait 30 days for domestic, 45 days for international shipments, to file for non-delivery claims. If damaged, the insured may file a notice of damage with Online Shipping Insurance Services immediately. All claims must be filed within 90 days of shipment to be honored. The insured will submit a completed Online Shipping Insurance Services claim form, copy of the original invoice to the consignee / original invoice from the shipper, whichever is applicable, a signed and dated statement from the consignee / receiving party, proof of damage if applicable and any additional documentation requested to substantiate the loss. Coverage does not include handling fees and insurance fees. All damaged property for which payment (not repair costs), or replacement costs have been made, must, on request, be returned to the Underwriters. Failure to hold the damaged property until the claim is fully resolved will result in the claim’s being denied.

The insured will have one (1) year from the date of the shipment to furnish any required and/or additional documentation requested by Online Shipping Insurance Services in order for the insured to substantiate said claim. Should the insured fail to provide the required and/or additional documentation within one (1) year from the ship date, the insured’s claim will be denied. Any covered loss will be promptly paid to the insured or their assignee after notice of loss or damage and the required documentation has been received and accepted by Underwriters in accordance with all terms and conditions of this coverage, unless property is replaced, at the option of the Underwriters, with like kind, function, and quality.

Upon payment for loss or damage, the Underwriters shall be subrogated to all the rights of the insured including whatever money may be recoverable. This payment excludes applicable deductible amounts corresponding to the claim settlement on account of said loss or damage from the carrier, or any of the carrier’s employees or agents, or from any other person or corporation whatsoever. The insured specifically covenants and agrees to aid the company in all manners possible to aid in securing reimbursement of said loss or damage. In the event the carrier admits to fraudulent activity from the carrier’s employees, the insured will take action against the carrier and not hold Online Shipping Insurance Services responsible for claims associated with said activity.

No suit, action or proceedings for the recovery of any claim under this coverage shall be sustainable in any court of law or entity unless the respective action is commenced within twelve (12) months after discovery by the insured of the issue giving rise to the claim, provided however, that said time limitation is invalid. In that case any such claim shall be void.

The insured or the Underwriters may terminate this policy at any time by giving fifteen (15) days written notice thereof, provided that such termination does not impact a shipment already in transit. Certified notice of cancellation sent to the insured at the last known address shall be deemed sufficient compliance with the conditions of this clause on the part of the Underwriters.