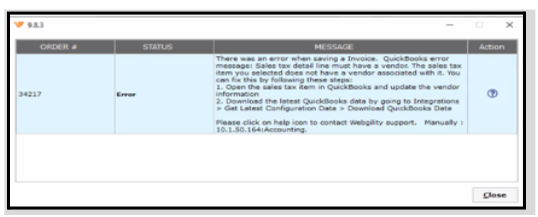

QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor

QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor

Cause of the error:

-

The error message "Sales tax detail line must have a vendor" can occur when syncing orders in QuickBooks Desktop if the vendor for the Sales Tax item has not been specified.

-

QuickBooks requires that each sales tax type item be associated with a vendor to manage tax payments and details properly.

Steps to fix this error:

To update the vendor in the sales tax item in QuickBooks Desktop, follow these steps:

-

Open QuickBooks Desktop: Launch your QuickBooks Desktop application.

-

Go to the Lists Menu: Click on the Lists menu at the top of the screen.

-

Select Item List: From the dropdown, choose Item List.

-

Find the Sales Tax Item: Scroll through the list to find the sales tax item you want to update. You can also use the search function if you have many items.

-

Edit the Sales Tax Item:

- Right-click on the sales tax item and select Edit Item.

- Alternatively, you can select the item and then click on the Item button at the bottom left and choose Edit Item. -

Update Vendor Information: In the Edit Item window, you will see various fields. Locate the vendor field (usually labeled as Vendor or Tax Agency). Update it with the correct vendor information.

-

Save Changes: After making your changes, click OK to save.

-

Verify Changes: To ensure the update was successful, revisit the Item List and confirm that the sales tax item reflects the new vendor information.

-

Post The Order To QuickBooks.

Note: If you encounter any issues, make sure the user is logged in as the admin has the necessary permissions to edit items.

If problems persist, consider reaching out to Webgility support for further assistance.