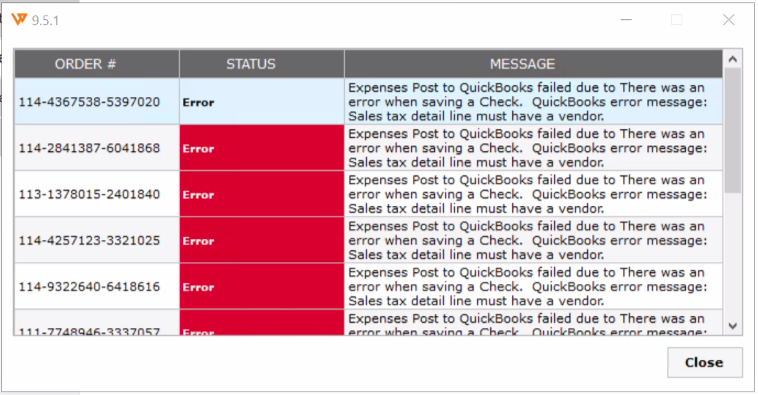

Expenses Post to QuickBooks Failed Due to There was an Error when Saving a Check. QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor.

Expenses Post to QuickBooks Failed Due to There was an Error when Saving a Check. QuickBooks Error Message: Sales Tax Detail Line Must Have a Vendor.

Reasons for this error message:

There are various scenarios for receiving this error. You might be running an older flow of Amazon Settlement report posting in Webgility Software. Another issue might be any expense account causing this issue.

Troubleshooting:

-

First and foremost you need to make sure that your Webgility Software is running the new Settlement Report flow for Amazon. Please refer to this help doc (click here) for a comparison. In case there is a difference please reach out to us and we will assist you in switching your Webgility Software to the new flow for Amazon report posting.

-

Once you have been moved to the new flow then make sure you log out and log back into Webgility on all of your required machines to apply all the changes.

-

Now you can try to post the report again. In case it still gives you the same error then in Webgility navigate to Integrations> Accounting> Posting Setting > Expenses and Fees to verify the expense account that is configured for Check setup under the expenses and fees settings.

-

Then navigate to your QuickBooks company file and try to create a “Check” manually with the same account. If it gives you any error then setup a new expense account, and download the latest accounting data in Webgility Software by going to Integrations> Get latest data and settings> Download Quickbooks Data and settings> Download Data.

-

Once done, navigate to Integrations> Accounting> Posting Settings> Expenses and Fees> and reconfigure the new expense account under all the configurations which are for “Check” setup.

-

Once done try to post the Amazon report again.

If the issue persists, please feel free to reach out.