Recommended Settings for Sales Tax for Webgility Desktop & QuickBooks Online

This article helps Webgility Desktop users configure sales tax settings in Webgility Desktop for accurate mapping with QuickBooks Online. Because sales tax configuration depends heavily on business model, geographic location, and compliance requirements, the article strongly recommends consulting a tax professional to determine the appropriate setup. Once finalized, users should communicate their preferences to their Webgility Desktop Implementation Specialist for proper configuration. The article also provides the recommended setup for clients seeking a simple and reliable tax mapping solution.

Recommended Sales Tax Settings for Webgility Desktop & Quickbooks Online

Sales tax configuration depends heavily on your business model, geographic location, and compliance requirements. We strongly recommend consulting with a tax professional to determine the right setup for your business. Once finalized, communicate your preferences to your Webgility Desktop Implementation Specialist for proper configuration.

Below is our recommended setup for clients looking for a simple and reliable tax mapping between Webgility Desktop and Quickbooks Online.

Webgility Desktop: Recommended Sales Tax Configuration

To configure sales tax behavior:

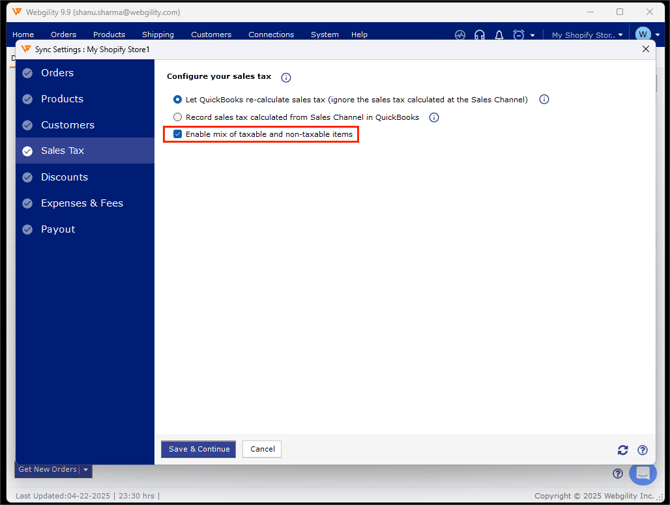

1). Navigate to: Connections → Accounting/POS/ERP → Sync Settings → Sales Tax

2). Enable: Record sales tax calculated from online sales channel as a line item in Quickbooks Online

This ensures Webgility Desktop uses the exact sales tax amount collected by your sales channel and passes it to Quickbooks Online as a line item, bypassing the Quickbooks Online tax engine. This method avoids discrepancies between platforms.

You will need to:

-

-

Select a Quickbooks Online item to record orders that include sales tax (e.g., “Sales Tax Collected”).

-

Select another item to record orders with no tax (e.g., “No Tax”).

-

3). Optional: If you sell a mix of taxable and non-taxable goods, enable the option for "Enable mix of taxable and non-taxable items"

4). If you prefer to use Quickbooks Online’ tax engine instead of your online sales channel’s calculated tax:

-

Select the option: Let Quickbooks re-calculate sales tax