Error - there is an invalid reference to QBs Invoice line item salestaxcode ''Non" in the invoice line. Quickbooks error message: you can't set taxable if sales tax is turned off or the item is not a

This article helps Webgility Desktop users resolve the QuickBooks Desktop error “Error - there is an invalid reference to QBs Invoice line item salestaxcode ''Non" in the invoice line. QuickBooks Desktop error message: you can't set taxable if sales tax is turned off or the item is not a taxable item type” which occurs when trying to post taxable items while sales tax is turned off or the item is not set as taxable in QuickBooks Desktop. It provides guidance on verifying that sales tax is enabled, ensuring items are taxable, confirming sales tax codes exist and are correct, and configuring Webgility Desktop tax settings to avoid conflicts. The article covers scenarios where QuickBooks Desktop sales tax is off and when line-item tax settings in Webgility conflict with QuickBooks Desktop, providing step-by-step instructions to correct these issues and successfully post orders.

Error Message

Error - there is an invalid reference to QBs Invoice line item salestaxcode ''Non" in the invoice line. QuickBooks Desktop error message: you can't set taxable if sales tax is turned off or the item is not a taxable item type

To resolve these errors, you may need to check the following:

1). Verify if sales tax is turned on in QuickBooks Desktop. If not, turn it on to allow taxable items to be posted.

2). Check if the item being posted is a taxable item type in QuickBooks Desktop. If not, change the item type to taxable.

3). Ensure that the sales tax code used for the item in QuickBooks Desktop exists and is spelled correctly. If not, create a new sales tax code or correct the spelling of the existing one.

Scenario 1: If the order has tax showing in Webgility Desktop but the Sales Tax feature is turned OFF in QuickBooks Desktop.

1). In your QuickBooks Desktop, log in as Admin and switch to Single-User mode.

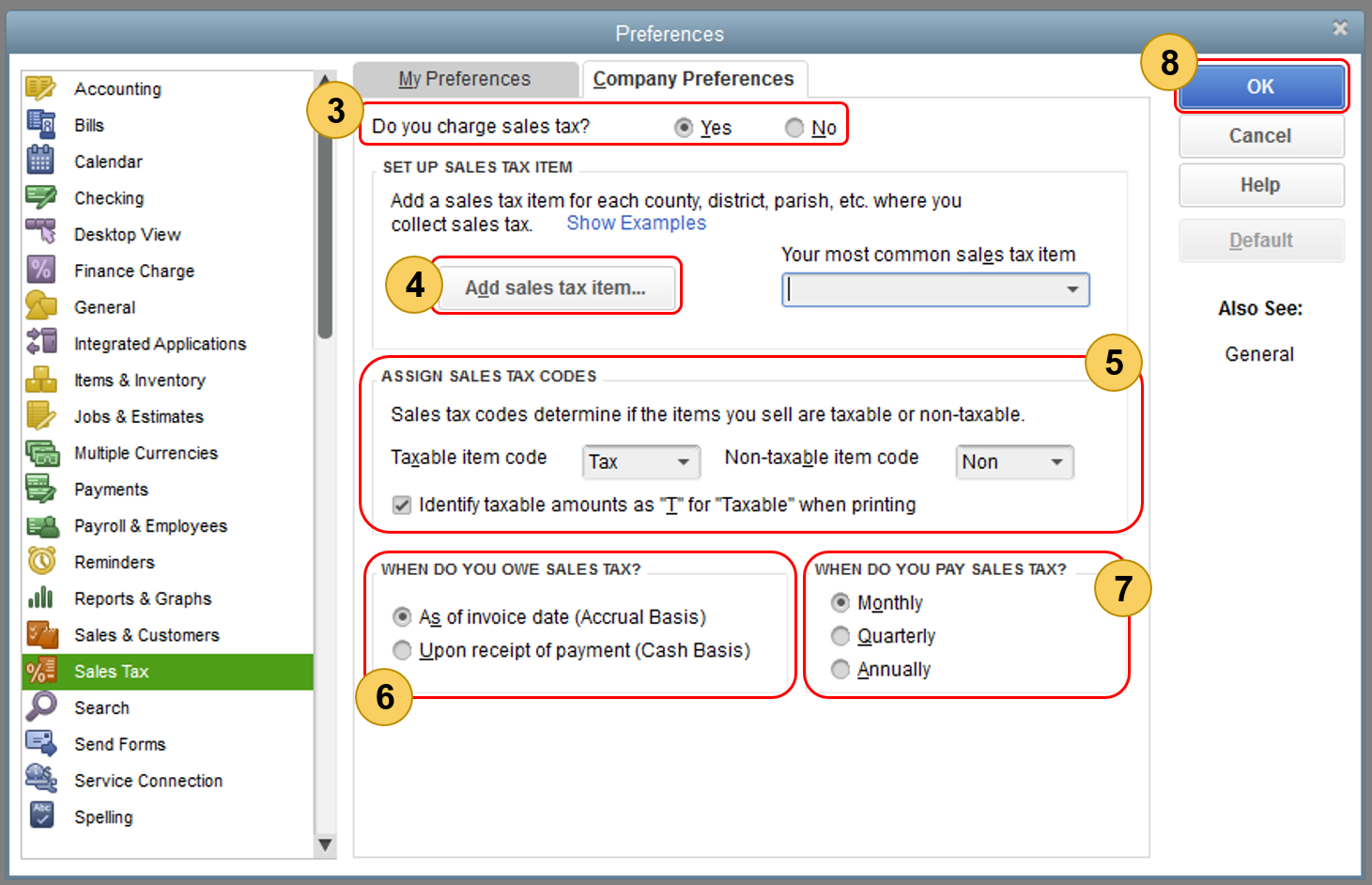

2). Then navigate to Edit> Preferences> Sales Tax> Company Preferences then select Yes to turn on Sales Tax. Make sure to set up the sales tax items or sales tax groups for each county, district, city, etc. where you collect sales tax. Click Add sales tax item to do this. You will also need to select Your most common sales tax item in the dropdown. For more information please refer to this QuickBooks Desktop help article (click here)

3). Once you set up QuickBooks Desktop with the sales tax feature, go back to the Webgility Desktop Software, navigate to Connections > Get latest data and settings> Download QuickBooks Desktop Data and Settings> Download Data to refresh the data.

4). Now select Connections > Accounting/POS/ERP > Sync Settings> Sales tax> choose the option to record sales channel tax as a line item OR let QuickBooks recalculate tax and then configure the tax settings accordingly then save the settings.

5). Now you can post the order that errored again to test that it posts properly.

Scenario 2: Both "Download tax as a line item" & Sales Tax settings are enabled in Webgility Desktop Software which conflicts internally causing this error

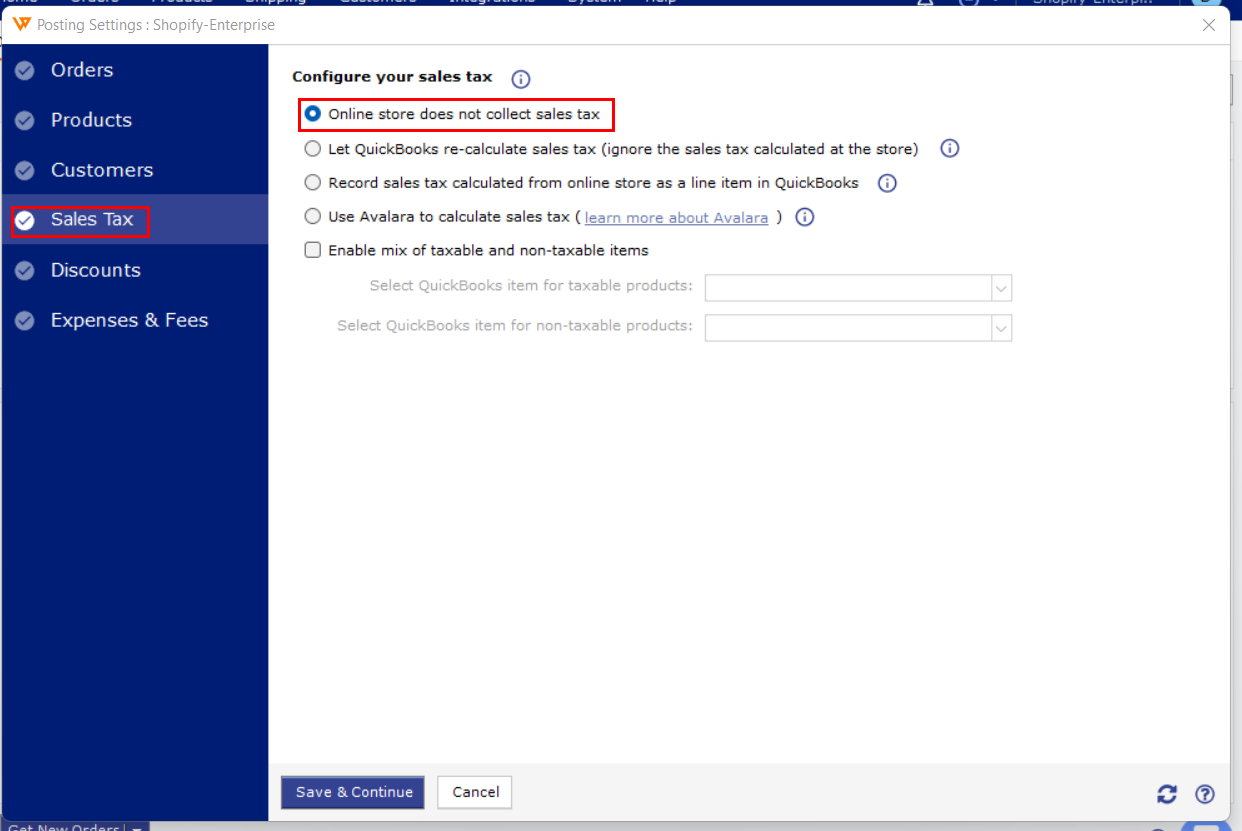

1). If you want to record tax as a line item in QuickBooks Desktop transactions and have enabled the following settings Connections > Sales Channels > Settings> Download sales tax as a line item. Then kindly configure the following settings under Connections > Accounting/POS/ERP > Posting Settings> Sales Tax > Online Store does not collect tax > Save and Continue.

Now you can post the order that errored again to test that it posts properly.